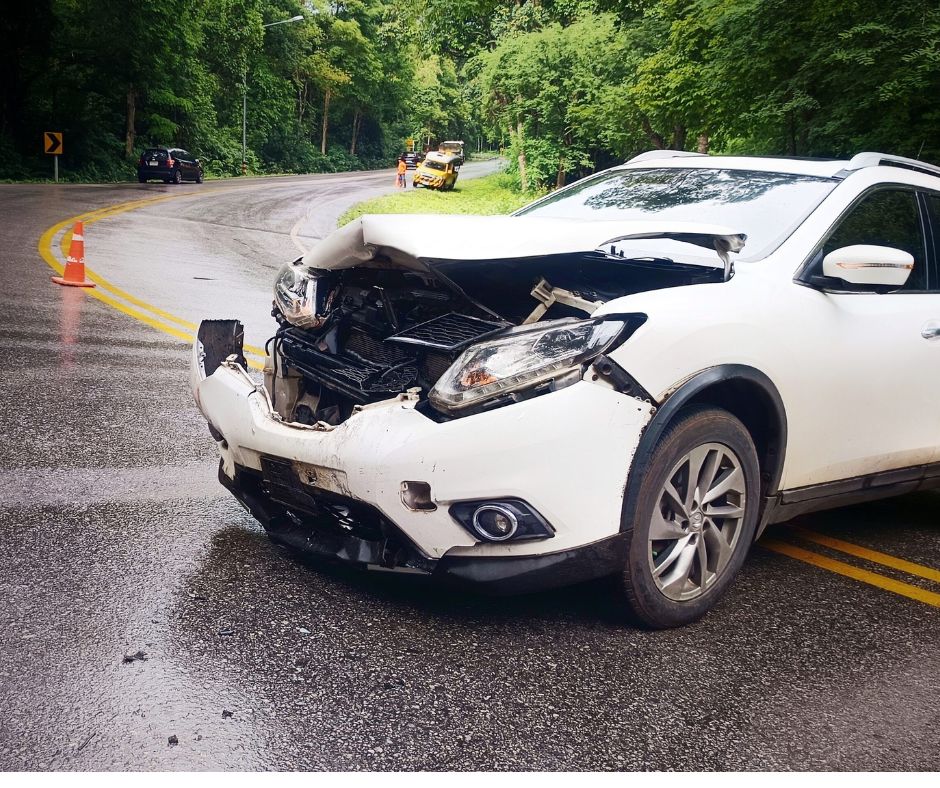

If you’ve recently been in a car accident in California, you might ask yourself, Is California a no-fault state, or is California an at-fault state?

The short answer is that California is one of 38 states that follow an at-fault policy. “At-fault” means the person responsible for the accident must pay for any damages they cause.

Moreover, California uses a pure comparative negligence system, which means that if a driver is partially responsible for a crash, they can still collect damages equivalent to the portion they are not at fault for.

Knowing whether a state subscribes to an at-fault versus no-fault system is essential. Both systems influence your compensation differently and significantly affect how insurance claims are handled post-accident.

Keep reading to learn more about at-fault policies in California and how they may impact you.

Get in touch with us online or call (209) 600-4389 today to schedule a free consultation, either in person or remotely. Our experienced California auto accident lawyers can help you understand your legal options.

What Is the Difference Between an At-Fault and No-Fault Insurance State?

Before exploring California’s specific regulations, it’s important to understand the difference between no-fault and at-fault states.

No-Fault State

In a no-fault state, drivers must file claims with their own insurers, regardless of who caused the accident.

This means the insurance company typically pays for a victim’s medical expenses and other damages, irrespective of who is at fault for the accident. This system speeds up the compensation process, as it doesn’t require the claimant to establish fault before paying out a claim.

However, no-fault states often restrict the right to sue the other party except in severe injury or death cases.

At-Fault State

In an at-fault state, the driver who caused the accident is responsible for compensating anyone who suffered harm.

This typically requires the injured party to file a claim against the at-fault driver’s insurance company or pursue a lawsuit against the at-fault driver. Determining fault plays a critical role in the outcome of cases in at-fault states, which means establishing responsibility is a crucial part of the legal and insurance process.

Is California a No-Fault State for Auto Accidents?

If you’re wondering, Is California a no-fault state for car accidents? the answer is no.

California follows an at-fault system under California Vehicle Code Section 17150. This code dictates that the owner of a motor vehicle is liable and responsible for deaths or injuries caused by negligent operation.

Being in a car accident in an at-fault state means if you’ve been injured, seeking compensation for your injuries and damages will involve proving that the other driver was at fault.

Further Reading: Should You Ever Admit Fault in a California Accident?

How Will California’s At-Fault Policies Affect My Claim?

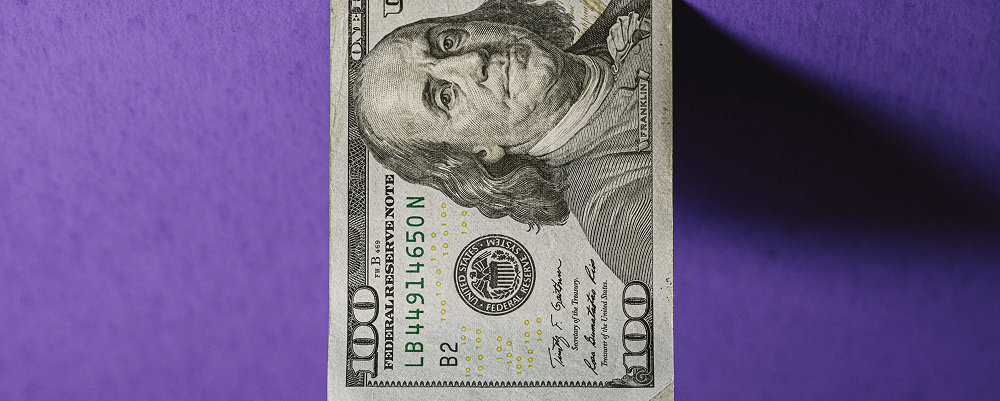

California requires all drivers to carry a minimum amount of liability auto insurance. Minimum liability coverage amounts ensure some accident protection and allow car accident victims to collect damages.

The minimum liability coverage in California will be increasing on January 1, 2025, but currently, the minimum coverage under California law is:

- $15,000 for injury/death to one person;

- $30,000 for injury/death to more than one person; and

- $5,000 for property damage.

While an at-fault driver’s insurance covers economic losses, such as property damage, medical expenses, lost wages, and other costs associated with the accident, injured parties may also pursue legal claims against at-fault drivers for non-economic damages, such as pain and suffering.

Moreover, depending on how long it takes an insurer to determine fault, drivers can file a claim with their own insurance company if they have applicable coverage. Types of coverage potentially relevant to a car accident victim’s expenses include collision and comprehensive.

Once the insurer determines the policyholder is not at fault, it can recoup the cost from the at-fault driver’s insurer.

It is important to understand that California follows pure comparative negligence rules. This means a crash victim can still claim damages if they share fault. However, insurers will reduce their recovery based on their percentage of blame for the accident. For example, if an insurer finds you 20% at fault, they may reduce your compensation by 20%. In other words, a car accident victim who is 55% responsible for a crash resulting in $200,000 of damages could still sue the other driver to collect up to $90,000 or 45% of the resulting damages.

Determining fault can be complex. It requires collecting and presenting evidence such as police reports, witness statements, and expert testimony. Fault is not always 100% clear-cut; several drivers may share it in some cases.

For this reason, it’s always a good idea to consult with an experienced auto accident attorney. A skilled attorney can review your case and help you establish a solid claim. Working with a car accident attorney can also significantly affect your case’s outcome, including the compensation you collect.

Remember, California laws protect your rights; a skilled attorney will help you enforce them.

Further Reading: Determining T-Bone Accident Fault in California

Contact the California Car Accident Lawyers at Silva Injury Law, Inc

Understanding California’s complex at-fault system and determining the best course of action after a car accident can be challenging.

But with Silva Injury Law on your side, you can rest assured knowing your claim is in good hands. At Silva Injury Law, we treat you like family and are committed to upholding a humane practice. We also understand that every case is unique and tailor our approach to meet each client’s needs and circumstances.

Our gold standard is finding solutions that address all aspects of our client’s claims and life. And our five-star rating is a testament to that goal.

Whether you need assistance with an auto accident claim or have other questions about your personal injury rights, we are here to help.

Contact us online or call (209) 600-4389 today for a free in-person or remote consultation.

We will never charge you money upfront or fees to handle your car accident case and are here to answer all your car accident questions.

EMAIL

EMAIL  AI-search

AI-search  Access

Access